What’s the Freddie Mac computer First Search Effort?

Such, a single-device HomePossible mortgage demands a minimum credit score regarding 660. A two- so you’re able to four-product possessions means a credit history out-of 700, and manufactured home need 720.

The initial Search Initiative exists because of the Freddie Mac and supply owner-occupant homeowners and pick non-winnings the capacity to get HomeSteps features for the very first 20 days of checklist.

What is good HomePossible matrix?

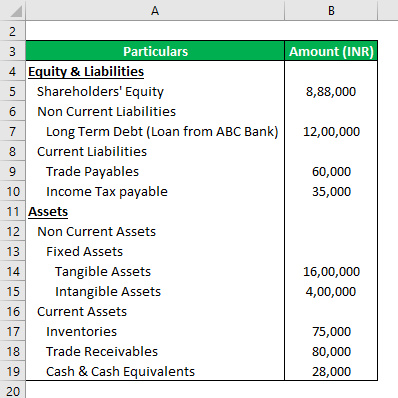

HomePossible is americash loans Kremmling actually a different sort of financing program that is designed to greatly help low in order to reasonable-income borrowers. Consumers can become eligible according to property’s address and you will income limitation number. Freddie Mac computer has created an item matrix that clearly portrays the new program’s qualification requirements, property variety of, income limit, home loan insurance, and. Lower than was Freddie Mac’s official PDF which covers everything required to understand: here

What’s the difference between HomePossible and you will an FHA mortgage?

FHA fund need individuals and also make a deposit as little just like the step 3.5% of your market value. Moreover it welcomes individuals with credit ratings only 580 to use. That it home loan was attractive to borrowers that have restricted finance and you can less than-mediocre fico scores. Once the FHA finance create borrowers and work out a little down payment, loan providers commonly point private home loan insurance rates (PMI). Which insurance premium simply protects the lending company in case your debtor finishes to make home loan repayments. The premium was computed to the full financing harmony and you will monthly mortgage repayments. Borrowers is also cure PMI in the event the harmony of its mortgage is at 80% of the the brand new appraised worth of your house.

HomePossible is a normal financial enabling borrowers while making an excellent low-down fee off 3 to 5 % of your home’s market value. But not, the product only it permits a thirty-year repaired-price mortgage on one-tool characteristics. HomePossible’s credit history standards and differ with regards to the kind of house ordered, along with income limits and you may homebuyer degree. Utilizing a beneficial HomePossible mortgage will save you individuals hundreds of dollars inside the attract given that lenders could offer straight down rates of interest than the most other mortgage issues.

Just what all of our customers say from the you?

People Funds are great to utilize otherwise getting property home loan. That it group was really short to resolve any questions one to emerged, were constantly trying to find ideal prices and on best of the many problems that emerged. Bringing a home loan is much regarding functions. If you’re looking getting a large financial company for purchasing a good home, I will suggest Society Money. They are going to make procedure simple and look away for your best interests. – Laurel Meters.

Society Money is actually a top-notch company to partner with. Their employees are experienced and you can useful from the whole process. I have used Area Money for most house purchases and you will refinances, I’d highly recommend them. The property owner Reno ‘s the real thing, the guy cares on his consumers and you may ensures Individuals are one hundred% met. – J. Conone

It forced me to out with a beneficial 203K mortgage back at my first property. Explained brand new tips of your process to me personally in advance of and you will while in the, and it’s really here as a consequence of text, phone call, or email of course, if requisite. Definitely manage suggest Community Loans if you are looking to buy an excellent house. My loved ones definitely is happy with the new set. Thank you again! – Marcin C.

HomePossible is actually a new financing unit offered by Freddie Mac computer you to definitely is designed for lowest in order to reasonable-money individuals. This choice happens to be offered to help lowest paid consumers finance home when you look at the lowest-money section.

What exactly is HomePossible?

HomePossible demands consumers to put down only step 3 to 5% of residence’s cost. The fresh down-payment is flexible, meaning, the funds may come away from many present, such a family member, help from company or supplementary resource out of a third-team organization.